“Beginner’s Guide to Travel Insurance: Navigating the World with Confidence

Related Articles Beginner’s Guide to Travel Insurance: Navigating the World with Confidence

- Beginner’s Guide To Travel Hacks And Essential Tools: Unlock Your Adventure

- Okay, Here’s A Comprehensive Article About An Advanced Travel Checklist Itinerary, Designed To Be Around 1600 Words.

- Affordable Solo Travel For Beginners: Exploring The World Without Breaking The Bank

- Affordable Travel Insurance Apps: Protecting Your Adventures Without Breaking The Bank

- Affordable Travel Safety: A Comprehensive Guide For Budget-Conscious Adventurers

Introduction

Today, we’re excited to unravel an engaging topic: Beginner’s Guide to Travel Insurance: Navigating the World with Confidence. Together, we’ll uncover insights that inform, inspire, and open new perspectives for our readers.

Table of Content

Beginner’s Guide to Travel Insurance: Navigating the World with Confidence

Travel is an enriching experience, offering opportunities for adventure, relaxation, and cultural immersion. However, unforeseen events can disrupt even the most meticulously planned trips. That’s where travel insurance comes in – a safety net designed to protect your financial investment and well-being while you’re away from home.

If you’re new to the world of travel insurance, the options and terminology can seem overwhelming. This beginner’s guide will break down the essentials, empowering you to make informed decisions and travel with peace of mind.

Why Do You Need Travel Insurance?

Travel insurance isn’t just an optional add-on; it’s a crucial component of responsible travel planning. Consider these scenarios:

- Medical Emergencies: Imagine falling ill or getting injured while traveling in a foreign country. Medical care can be incredibly expensive, and your domestic health insurance may not provide adequate coverage abroad. Travel insurance can cover medical expenses, emergency evacuation, and repatriation (returning you home for treatment).

- Trip Cancellation or Interruption: Life happens. Unexpected events like illness, family emergencies, or natural disasters can force you to cancel or cut short your trip. Travel insurance can reimburse you for non-refundable expenses like flights, hotels, and tours.

- Lost or Stolen Belongings: Losing your luggage, having your passport stolen, or experiencing theft can be stressful and costly. Travel insurance can help you replace essential items and cover the cost of replacing your passport.

- Travel Delays: Flight delays, missed connections, or other travel disruptions can throw your itinerary into chaos. Travel insurance can cover expenses like meals, accommodation, and transportation incurred due to delays.

Types of Travel Insurance Coverage

Travel insurance policies typically offer a range of coverage options. Here are some of the most common:

-

Trip Cancellation Coverage:

- What it covers: Reimburses you for non-refundable trip costs if you have to cancel your trip due to a covered reason (e.g., illness, injury, death of a family member, natural disaster).

- Important Considerations:

- Covered Reasons: Carefully review the policy to understand what constitutes a covered reason for cancellation.

- Documentation: You’ll need to provide documentation (e.g., doctor’s note, death certificate) to support your claim.

- Pre-Existing Conditions: Some policies may exclude coverage for pre-existing medical conditions.

-

Trip Interruption Coverage:

- What it covers: Reimburses you for unused, non-refundable trip costs and additional expenses (e.g., transportation, accommodation) if your trip is interrupted due to a covered reason.

- Important Considerations:

- Covered Reasons: Similar to trip cancellation, understand the covered reasons for interruption.

- Pro-Rated Reimbursement: Reimbursement is typically pro-rated based on the portion of the trip that was interrupted.

-

Medical Expense Coverage:

- What it covers: Pays for medical expenses incurred due to illness or injury while traveling. This can include doctor’s visits, hospital stays, medication, and diagnostic tests.

- Important Considerations:

- Coverage Limits: Check the policy’s coverage limits for medical expenses.

- Deductibles: Understand the deductible you’ll need to pay before coverage kicks in.

- Pre-Approval: Some policies require pre-approval for certain medical treatments.

-

Emergency Medical Evacuation Coverage:

- What it covers: Covers the cost of transporting you to the nearest adequate medical facility or back home if you require emergency medical treatment.

- Important Considerations:

- High Costs: Medical evacuation can be incredibly expensive, especially from remote locations.

- Policy Limits: Ensure the policy’s coverage limits are sufficient for potential evacuation costs.

-

Baggage Loss, Damage, or Delay Coverage:

- What it covers: Reimburses you for lost, stolen, or damaged baggage. It may also cover expenses incurred due to baggage delays.

- Important Considerations:

- Coverage Limits: There are usually limits on the amount you can claim for baggage loss or damage.

- Documentation: You’ll need to provide proof of ownership and the value of your belongings.

- Exclusions: Some items (e.g., jewelry, electronics) may be excluded from coverage or have lower limits.

-

Travel Delay Coverage:

- What it covers: Reimburses you for expenses (e.g., meals, accommodation) incurred due to travel delays caused by covered reasons (e.g., weather, mechanical issues).

- Important Considerations:

- Minimum Delay: Policies typically require a minimum delay (e.g., 6 hours) before coverage kicks in.

- Documentation: Keep receipts for all expenses incurred due to the delay.

-

Accidental Death and Dismemberment (AD&D) Coverage:

- What it covers: Provides a lump-sum payment to you or your beneficiaries in the event of accidental death or dismemberment during your trip.

- Important Considerations:

- Coverage Amount: Consider the coverage amount when choosing a policy.

- Beneficiary Designation: Designate a beneficiary to receive the payment in the event of your death.

How to Choose the Right Travel Insurance Policy

Selecting the right travel insurance policy requires careful consideration of your individual needs and circumstances. Here’s a step-by-step guide:

-

Assess Your Needs:

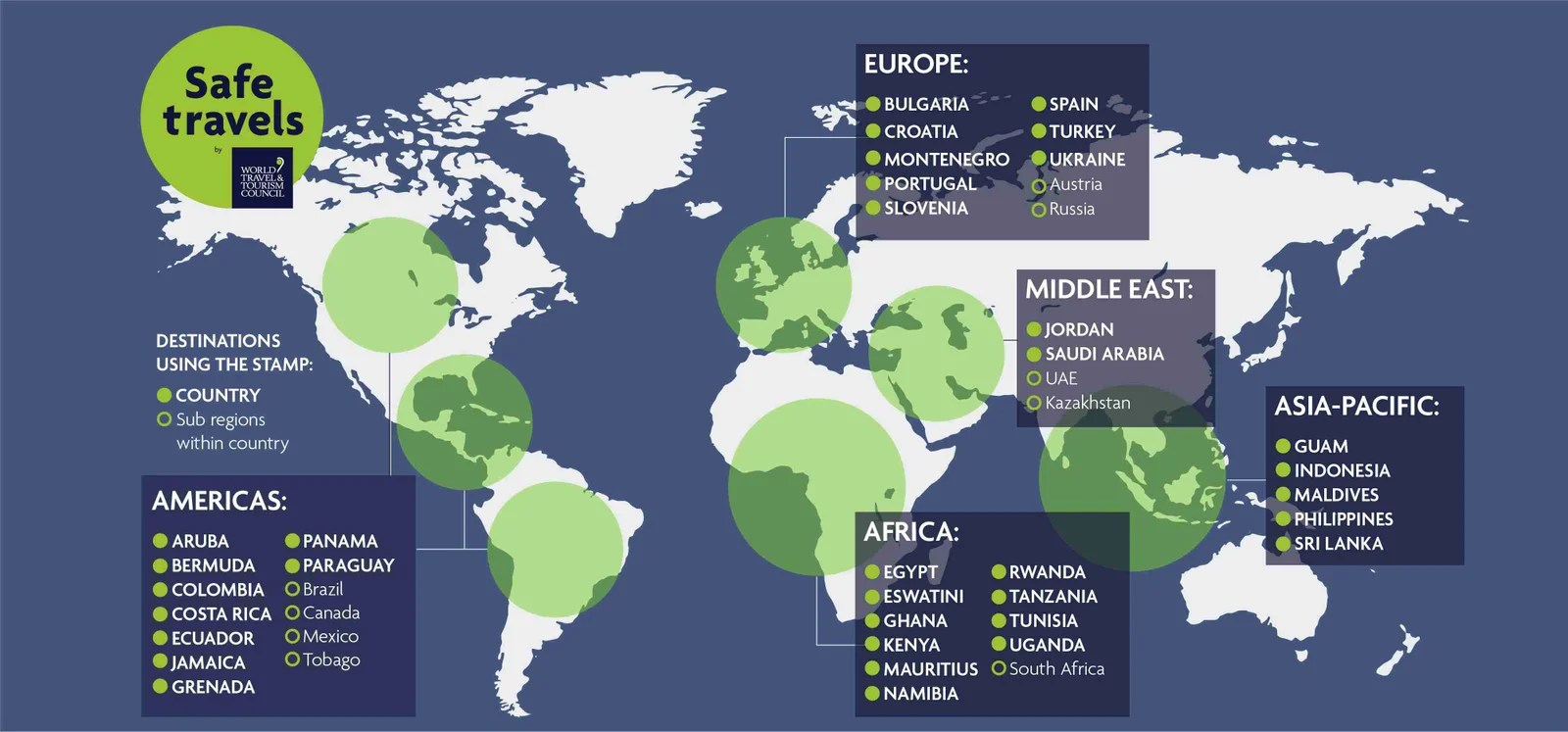

- Destination: Consider the potential risks associated with your destination (e.g., political instability, health concerns).

- Activities: If you plan to engage in adventurous activities (e.g., hiking, skiing), ensure the policy covers them.

- Pre-Existing Conditions: If you have any pre-existing medical conditions, check if the policy covers them.

- Trip Cost: Determine the total cost of your trip to ensure you have adequate coverage for trip cancellation and interruption.

-

Compare Policies:

- Coverage Options: Compare the coverage options offered by different policies.

- Coverage Limits: Pay attention to the coverage limits for each type of coverage.

- Deductibles: Consider the deductible you’ll need to pay before coverage kicks in.

- Exclusions: Carefully review the policy’s exclusions to understand what is not covered.

- Price: Compare the prices of different policies, but don’t base your decision solely on price.

-

Read the Fine Print:

- Policy Wording: Carefully read the policy wording to understand the terms and conditions of coverage.

- Definitions: Pay attention to the definitions of key terms (e.g., "covered reason," "pre-existing condition").

- Claims Process: Understand the process for filing a claim.

-

Consider Optional Add-Ons:

- Cancel For Any Reason (CFAR) Coverage: Allows you to cancel your trip for any reason and receive a partial refund (typically 50-75%).

- Adventure Sports Coverage: Covers injuries sustained while participating in adventure sports.

- Rental Car Coverage: Provides coverage for damage to rental cars.

Tips for Buying Travel Insurance

- Buy Early: Purchase travel insurance as soon as you book your trip to protect yourself from unexpected events that may occur before your departure.

- Shop Around: Compare policies from multiple providers to find the best coverage at the best price.

- Read Reviews: Check online reviews to get an idea of other travelers’ experiences with different insurance providers.

- Ask Questions: Don’t hesitate to contact the insurance provider with any questions you have before purchasing a policy.

- Keep Your Policy Information Handy: Store a copy of your policy information in a safe place and share it with a family member or friend.

Filing a Claim

If you need to file a claim, follow these steps:

- Notify the Insurance Company: Contact the insurance company as soon as possible after the event occurs.

- Gather Documentation: Collect all relevant documentation, such as medical records, police reports, receipts, and travel itineraries.

- Complete the Claim Form: Fill out the claim form accurately and completely.

- Submit Your Claim: Submit your claim and all supporting documentation to the insurance company.

- Follow Up: Follow up with the insurance company to check on the status of your claim.

Common Mistakes to Avoid

- Assuming Your Credit Card Offers Adequate Coverage: Credit card travel insurance often has limited coverage and may not be sufficient for your needs.

- Failing to Read the Policy: Understanding the terms and conditions of your policy is crucial.

- Not Disclosing Pre-Existing Conditions: Failing to disclose pre-existing medical conditions can invalidate your coverage.

- Waiting Too Long to File a Claim: File your claim as soon as possible after the event occurs.

Conclusion

Travel insurance is an essential investment for any traveler. By understanding the different types of coverage, comparing policies, and reading the fine print, you can choose a policy that meets your individual needs and provides peace of mind while you explore the world. Don’t leave home without it!