“A Daily Currency Exchange Checklist

Related Articles A Daily Currency Exchange Checklist

- Comprehensive Airport Tips For Couples: Navigating Travel Together With Ease

- Comprehensive Currency Exchange 2025: A Deep Dive Into The Future Of Global Finance

- Beginner Travel Tips Strategies

- Affordable Travel App Essentials: Your Pocket-Sized Guide To Smarter, Cheaper Adventures

- Best Currency Exchange 2025

Introduction

On this special occasion, we’re delighted to explore an engaging topic: A Daily Currency Exchange Checklist. Together, we’ll uncover insights that inform, inspire, and open new perspectives for our readers.

Table of Content

A Daily Currency Exchange Checklist

In the world of international finance, where transactions transcend borders and economies intertwine, the daily currency exchange plays a pivotal role. Whether you’re a seasoned investor, a business owner engaged in global trade, or an individual planning an overseas trip, the ability to navigate the currency exchange market effectively is paramount. To ensure you’re making informed decisions and optimizing your financial outcomes, a comprehensive daily currency exchange checklist is an indispensable tool.

Understanding the Importance of a Daily Currency Exchange Checklist

Before we delve into the specifics of the checklist, let’s first understand why it’s so crucial:

-

Mitigating Risk: Currency exchange rates are inherently volatile. A checklist helps you assess and mitigate the risks associated with these fluctuations, preventing potential financial losses.

-

Informed Decision-Making: By systematically evaluating various factors, a checklist empowers you to make well-informed decisions about when and how to exchange currencies.

-

Cost Optimization: Currency exchange involves fees, commissions, and spreads. A checklist guides you in identifying the most cost-effective options, maximizing your returns.

-

Compliance: Businesses operating internationally must adhere to regulatory requirements related to currency exchange. A checklist ensures compliance and avoids legal complications.

-

Efficiency: A structured checklist streamlines the currency exchange process, saving you time and effort while minimizing errors.

The Daily Currency Exchange Checklist: A Step-by-Step Guide

Now, let’s explore the essential components of a comprehensive daily currency exchange checklist:

1. Define Your Objectives

- Purpose of Exchange: Clearly define why you need to exchange currencies. Is it for international trade, investment, travel, or other purposes?

- Amount Required: Determine the exact amount of foreign currency you need. Avoid exchanging more than necessary, as holding excess currency can expose you to unnecessary risk.

- Time Horizon: Establish a timeframe for when you need the foreign currency. This will influence your strategy, as short-term needs may require different approaches than long-term investments.

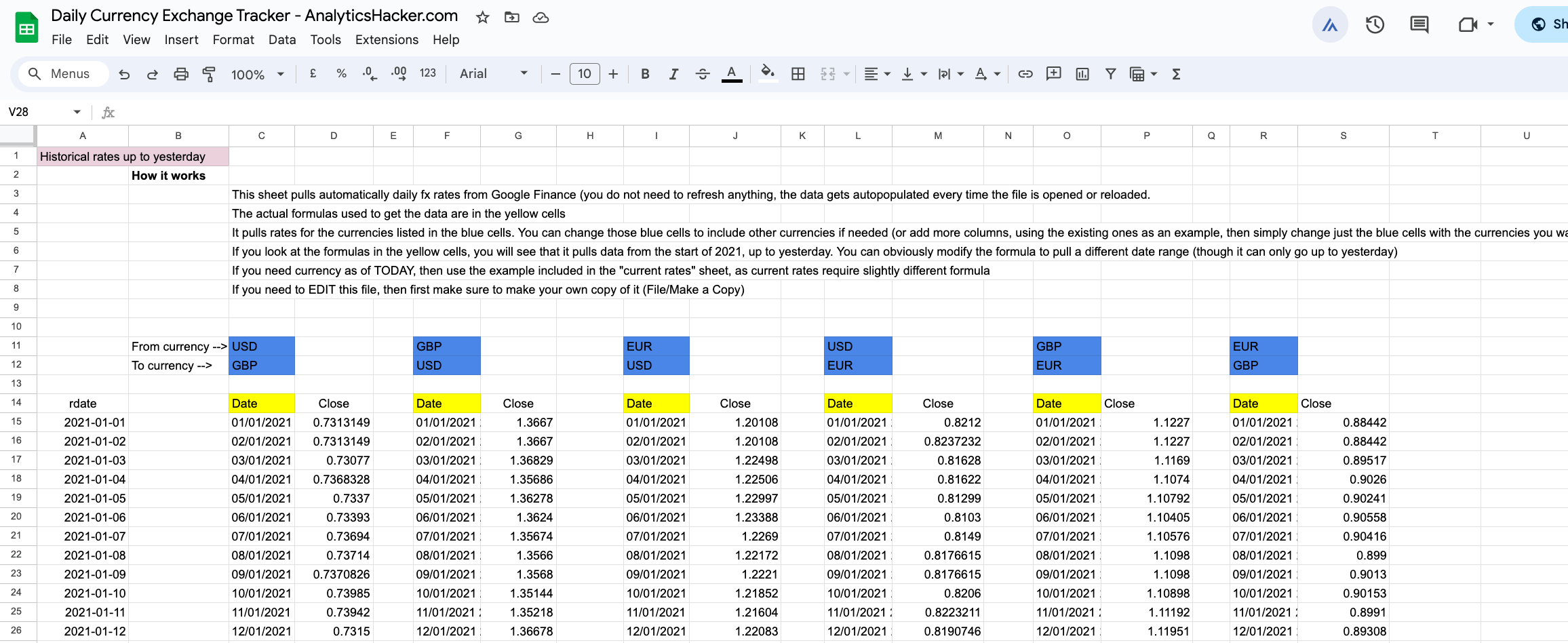

2. Monitor Exchange Rates

- Track Key Currency Pairs: Identify the currency pairs relevant to your needs and track their exchange rates throughout the day.

- Utilize Reliable Sources: Rely on reputable financial news outlets, currency converters, and trading platforms for accurate and up-to-date exchange rate information.

- Set Rate Alerts: Configure alerts to notify you when your target exchange rates are reached, enabling you to act quickly when favorable opportunities arise.

3. Analyze Market Trends

- Review Economic News: Stay informed about economic indicators, political events, and geopolitical developments that can impact currency values.

- Assess Technical Analysis: If you’re familiar with technical analysis, use charts and indicators to identify potential trends and patterns in currency movements.

- Consider Expert Opinions: Consult with financial analysts and currency experts to gain insights into market sentiment and potential future movements.

4. Evaluate Exchange Options

- Banks: Banks offer currency exchange services, but their rates may not always be the most competitive.

- Currency Exchange Bureaus: These specialized businesses often provide better rates than banks, but fees can vary widely.

- Online Platforms: Online currency exchange platforms offer convenience and competitive rates, but it’s essential to choose reputable providers.

- Brokers: Currency brokers can provide personalized advice and access to wholesale rates, but their services may come with higher fees.

5. Compare Exchange Rates and Fees

- Obtain Quotes: Request quotes from multiple sources to compare exchange rates and fees.

- Calculate Total Costs: Factor in all costs, including commissions, transaction fees, and any hidden charges.

- Negotiate Rates: Don’t hesitate to negotiate rates, especially for large transactions.

6. Verify Regulatory Compliance

- Check Licensing: Ensure that the currency exchange provider is licensed and regulated by the appropriate authorities.

- Understand Reporting Requirements: Be aware of any reporting requirements related to currency exchange transactions, especially for businesses.

- Comply with Anti-Money Laundering (AML) Regulations: Adhere to AML regulations to prevent illicit financial activities.

7. Security Measures

- Secure Transactions: Use secure methods for transferring funds and exchanging currencies to protect against fraud and cyber threats.

- Verify Counterparties: Verify the identity and legitimacy of counterparties before engaging in currency exchange transactions.

- Protect Personal Information: Safeguard your personal and financial information to prevent identity theft and unauthorized access.

8. Documentation

- Maintain Records: Keep detailed records of all currency exchange transactions, including dates, amounts, exchange rates, and fees.

- Retain Receipts: Retain receipts and confirmations for all transactions.

- Comply with Tax Requirements: Ensure compliance with tax regulations related to currency exchange transactions.

9. Risk Management

- Set Stop-Loss Orders: If you’re holding foreign currency for investment purposes, consider setting stop-loss orders to limit potential losses.

- Hedge Currency Exposure: Businesses can hedge their currency exposure using financial instruments like forward contracts and options.

- Diversify Currency Holdings: Diversifying your currency holdings can reduce risk by spreading exposure across multiple currencies.

10. Stay Informed

- Monitor Market Developments: Continuously monitor market developments and adjust your strategy as needed.

- Seek Professional Advice: Consult with financial advisors and currency experts for guidance and insights.

- Adapt to Changing Conditions: Be prepared to adapt your strategy to changing market conditions and regulatory requirements.

11. Regular Review

- Assess Performance: Periodically assess the performance of your currency exchange strategy.

- Identify Areas for Improvement: Identify areas where you can improve your decision-making and cost optimization.

- Update Checklist: Update your checklist to reflect changes in market conditions and regulatory requirements.

12. Technology and Tools

- Currency Converter Apps: Use currency converter apps to quickly calculate exchange rates.

- Financial News Websites: Stay updated with financial news and market analysis through reputable websites.

- Trading Platforms: Explore trading platforms for advanced charting tools and real-time data.

13. Timing Considerations

- Optimal Exchange Times: Research and identify the times of day when exchange rates are most favorable.

- Avoid Peak Hours: Avoid exchanging currency during peak hours when spreads tend to be wider.

- Consider Market Overlap: Take advantage of market overlap when multiple trading sessions are active.

14. Long-Term vs. Short-Term Strategies

- Long-Term Investments: For long-term investments, consider strategies like dollar-cost averaging to mitigate risk.

- Short-Term Needs: For short-term needs, focus on securing the best available rates and minimizing transaction costs.

- Adjust Based on Goals: Tailor your strategy based on whether you’re investing, traveling, or conducting business.

15. Alternative Payment Methods

- Credit Cards: While convenient, credit cards often have high exchange rates and fees.

- Debit Cards: Debit cards may offer better rates than credit cards but can still incur fees.

- Prepaid Travel Cards: Consider prepaid travel cards for managing expenses while traveling abroad.

- Digital Wallets: Explore digital wallets for potentially lower fees and competitive exchange rates.

16. Seek Professional Advice

- Financial Advisors: Consult with financial advisors for personalized guidance based on your financial goals.

- Currency Exchange Experts: Seek advice from currency exchange experts for insights into market trends and strategies.

- Tax Professionals: Ensure compliance with tax regulations by consulting with tax professionals.

Conclusion

In the dynamic world of currency exchange, a daily checklist is your compass and guide. By systematically following each step, you can navigate the complexities of the market with confidence, optimize your financial outcomes, and minimize risks. Whether you’re a seasoned investor or a first-time traveler, mastering the art of currency exchange is an invaluable skill that can significantly impact your financial well-being. Embrace the power of a daily currency exchange checklist and embark on your journey toward financial success in the global marketplace.