“Group Travel Insurance Download: A Comprehensive Guide to Protecting Your Group Adventures

Related Articles Group Travel Insurance Download: A Comprehensive Guide to Protecting Your Group Adventures

- Family Jet Lag Cure Hacks: Minimizing Disruption And Maximizing Enjoyment

- The Ultimate Easy Airport Tips Checklist For Stress-Free Travel

- Beginner’s Guide: Essential Travel Safety Apps To Keep You Secure On Your Adventures

- Family Travel Hacks: Your Guide To Stress-Free Adventures

- Daily Travel Document Disasters: Averting Common Mistakes That Can Derail Your Trip

Introduction

On this special occasion, we’re delighted to explore an engaging topic: Group Travel Insurance Download: A Comprehensive Guide to Protecting Your Group Adventures. Join us as we navigate insights that inform, inspire, and open new perspectives for our readers.

Table of Content

Group Travel Insurance Download: A Comprehensive Guide to Protecting Your Group Adventures

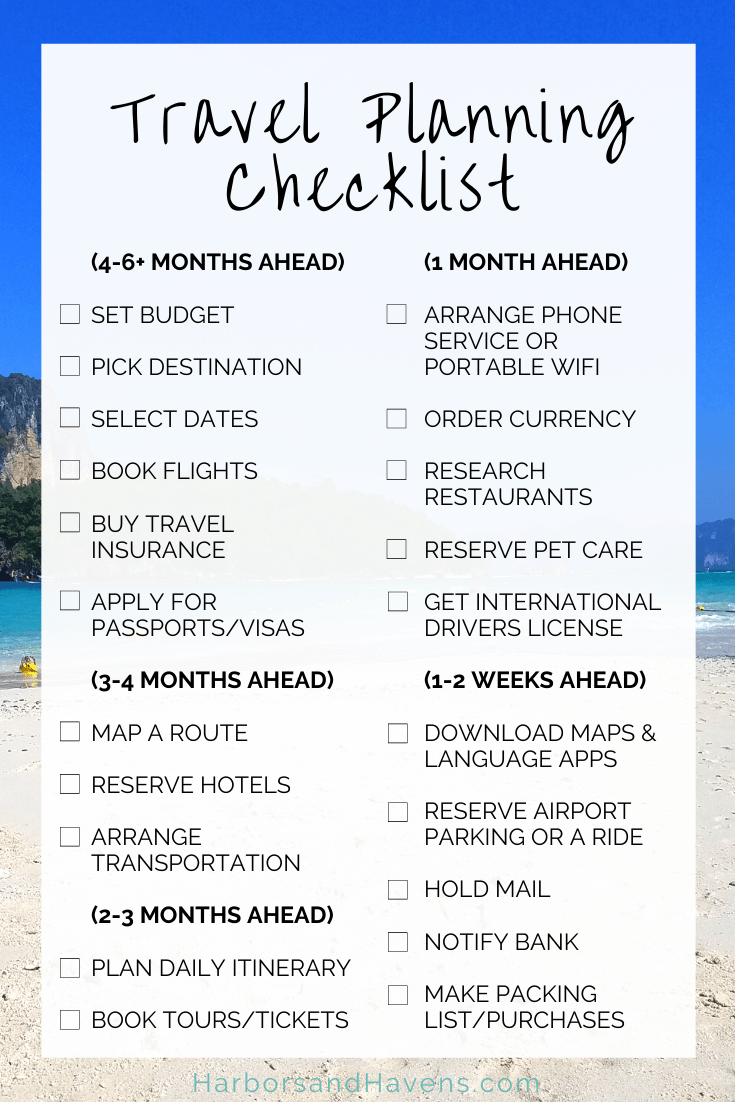

Traveling with a group can be an incredibly rewarding experience, fostering camaraderie, creating shared memories, and allowing you to explore new destinations with friends, family, or colleagues. However, group travel also presents unique challenges and risks that solo travelers or families might not encounter. From unexpected illnesses and injuries to lost luggage and trip cancellations, unforeseen events can disrupt your group’s itinerary and lead to significant financial burdens. This is where group travel insurance steps in, offering a safety net that protects your group’s investment and ensures a smooth and worry-free travel experience.

In this comprehensive guide, we’ll delve into the world of group travel insurance, exploring its benefits, coverage options, factors to consider when choosing a policy, and how to download and access your insurance documents. Whether you’re planning a family reunion, a corporate retreat, or a school trip, this guide will equip you with the knowledge to make informed decisions and secure the right group travel insurance for your needs.

What is Group Travel Insurance?

Group travel insurance is a type of insurance policy designed to cover a group of individuals traveling together on the same itinerary. Unlike individual travel insurance, which covers only one person, group travel insurance provides coverage for multiple travelers under a single policy. This can be a cost-effective and convenient way to protect your group from unexpected events that may occur before or during your trip.

Benefits of Group Travel Insurance

Group travel insurance offers a wide range of benefits that can safeguard your group’s travel investment and provide peace of mind throughout your journey. Here are some key advantages:

- Cost Savings: Group travel insurance policies often offer discounted rates compared to purchasing individual policies for each traveler. This can result in significant cost savings, especially for larger groups.

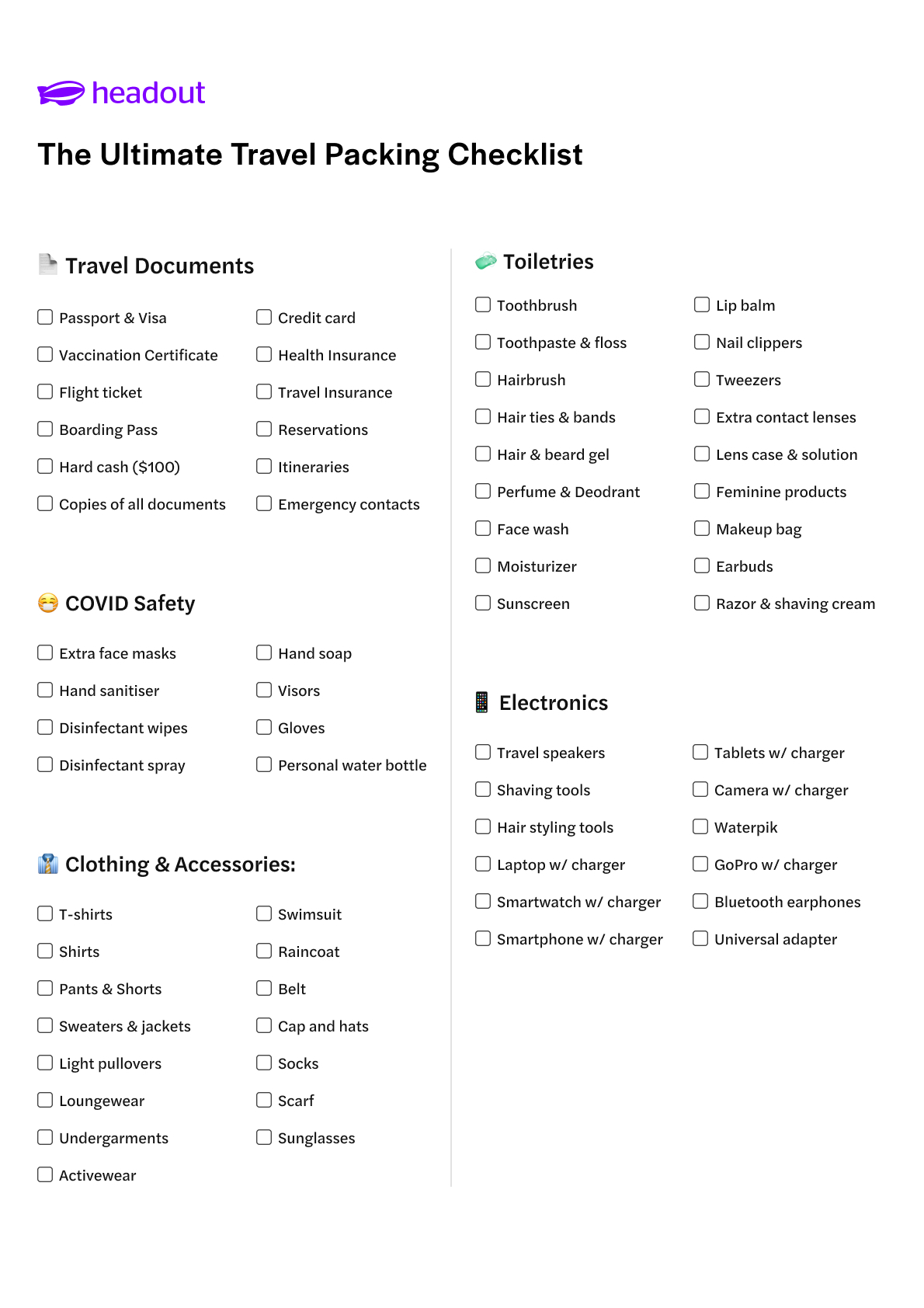

- Comprehensive Coverage: Group travel insurance policies typically provide comprehensive coverage for a variety of travel-related risks, including medical emergencies, trip cancellations, lost luggage, and travel delays.

- Convenience: Managing a single group travel insurance policy is much easier than handling multiple individual policies. This simplifies the process of filing claims and coordinating coverage for the entire group.

- Peace of Mind: Knowing that your group is protected by a comprehensive insurance policy can provide peace of mind and allow you to focus on enjoying your travel experience.

- 24/7 Assistance: Many group travel insurance providers offer 24/7 assistance services, providing support and guidance in case of emergencies or unexpected events.

Coverage Options in Group Travel Insurance

Group travel insurance policies typically offer a range of coverage options that can be tailored to your group’s specific needs and travel plans. Here are some common coverage areas:

- Medical Expenses: This coverage provides reimbursement for medical expenses incurred due to illness or injury while traveling, including doctor’s visits, hospital stays, medication, and emergency medical evacuation.

- Trip Cancellation: This coverage reimburses non-refundable trip costs if you have to cancel your trip due to unforeseen circumstances, such as illness, injury, or a family emergency.

- Trip Interruption: This coverage reimburses non-refundable trip costs if your trip is interrupted due to unforeseen circumstances, such as illness, injury, or a natural disaster.

- Lost or Delayed Luggage: This coverage reimburses you for the cost of replacing lost or delayed luggage, as well as essential items you need to purchase while your luggage is delayed.

- Travel Delay: This coverage reimburses you for expenses incurred due to travel delays, such as meals, accommodation, and transportation.

- Emergency Evacuation: This coverage provides transportation to the nearest appropriate medical facility in case of a medical emergency.

- Accidental Death and Dismemberment: This coverage provides a lump-sum payment in the event of accidental death or dismemberment during your trip.

- Personal Liability: This coverage protects you against financial losses if you are held liable for causing injury or damage to someone else’s property while traveling.

Factors to Consider When Choosing Group Travel Insurance

Choosing the right group travel insurance policy requires careful consideration of your group’s specific needs and travel plans. Here are some key factors to consider:

- Group Size: The size of your group will affect the cost of the policy and the coverage options available.

- Destination: The destination of your trip will influence the type of coverage you need, as medical costs and travel risks vary from country to country.

- Trip Duration: The length of your trip will affect the cost of the policy and the amount of coverage you need.

- Activities: If your group plans to participate in adventurous activities, such as skiing, scuba diving, or mountain climbing, you’ll need to ensure that your policy covers these activities.

- Pre-Existing Medical Conditions: If any members of your group have pre-existing medical conditions, you’ll need to disclose these conditions to the insurance provider and ensure that your policy provides adequate coverage.

- Coverage Limits: Review the coverage limits for each benefit to ensure that they are sufficient to meet your group’s needs.

- Deductibles: Consider the deductible amount, which is the amount you’ll have to pay out of pocket before your insurance coverage kicks in.

- Exclusions: Carefully review the policy exclusions to understand what is not covered by the policy.

- Provider Reputation: Choose a reputable insurance provider with a strong track record of customer service and claims handling.

- Cost: Compare quotes from multiple providers to find the best value for your money.

How to Download Group Travel Insurance Documents

Once you’ve purchased a group travel insurance policy, you’ll need to download and access your insurance documents. Here’s how:

- Check Your Email: After purchasing your policy, you should receive an email from the insurance provider containing a link to download your insurance documents.

- Log In to Your Account: If you created an account on the insurance provider’s website, you can log in to your account and download your insurance documents from there.

- Contact Customer Service: If you’re unable to find your insurance documents, contact the insurance provider’s customer service department for assistance.

Your insurance documents will typically include the following:

- Policy Certificate: This document provides a summary of your coverage and policy details.

- Policy Wording: This document contains the full terms and conditions of your policy.

- Claims Form: This form is used to file a claim for reimbursement of expenses.

- Emergency Assistance Contact Information: This information provides contact details for the insurance provider’s emergency assistance services.

Tips for Using Group Travel Insurance

- Read Your Policy Carefully: Take the time to read your policy carefully and understand the coverage, exclusions, and claims process.

- Carry Your Insurance Documents: Keep a copy of your insurance documents with you at all times during your trip.

- Know Your Policy Number: Memorize your policy number or keep it readily accessible in case of an emergency.

- Contact the Insurance Provider Immediately in Case of an Emergency: If you experience a medical emergency or other covered event, contact the insurance provider immediately for assistance.

- Keep All Receipts and Documentation: Keep all receipts and documentation related to your claim, such as medical bills, police reports, and travel itineraries.

- File Your Claim Promptly: File your claim as soon as possible after the covered event occurs.

Conclusion

Group travel insurance is an essential investment for any group traveling together. It provides comprehensive coverage for a variety of travel-related risks, protects your group’s investment, and ensures a smooth and worry-free travel experience. By carefully considering your group’s needs and travel plans, comparing quotes from multiple providers, and understanding the terms and conditions of your policy, you can choose the right group travel insurance and embark on your adventure with confidence. Remember to download and keep your insurance documents readily accessible, and don’t hesitate to contact your insurance provider for assistance if you encounter any unexpected events during your trip. With the right group travel insurance in place, you can focus on creating lasting memories with your group and enjoying the journey.