“Affordable Currency Exchange: Navigating the World of Global Finance Without Breaking the Bank

Related Articles Affordable Currency Exchange: Navigating the World of Global Finance Without Breaking the Bank

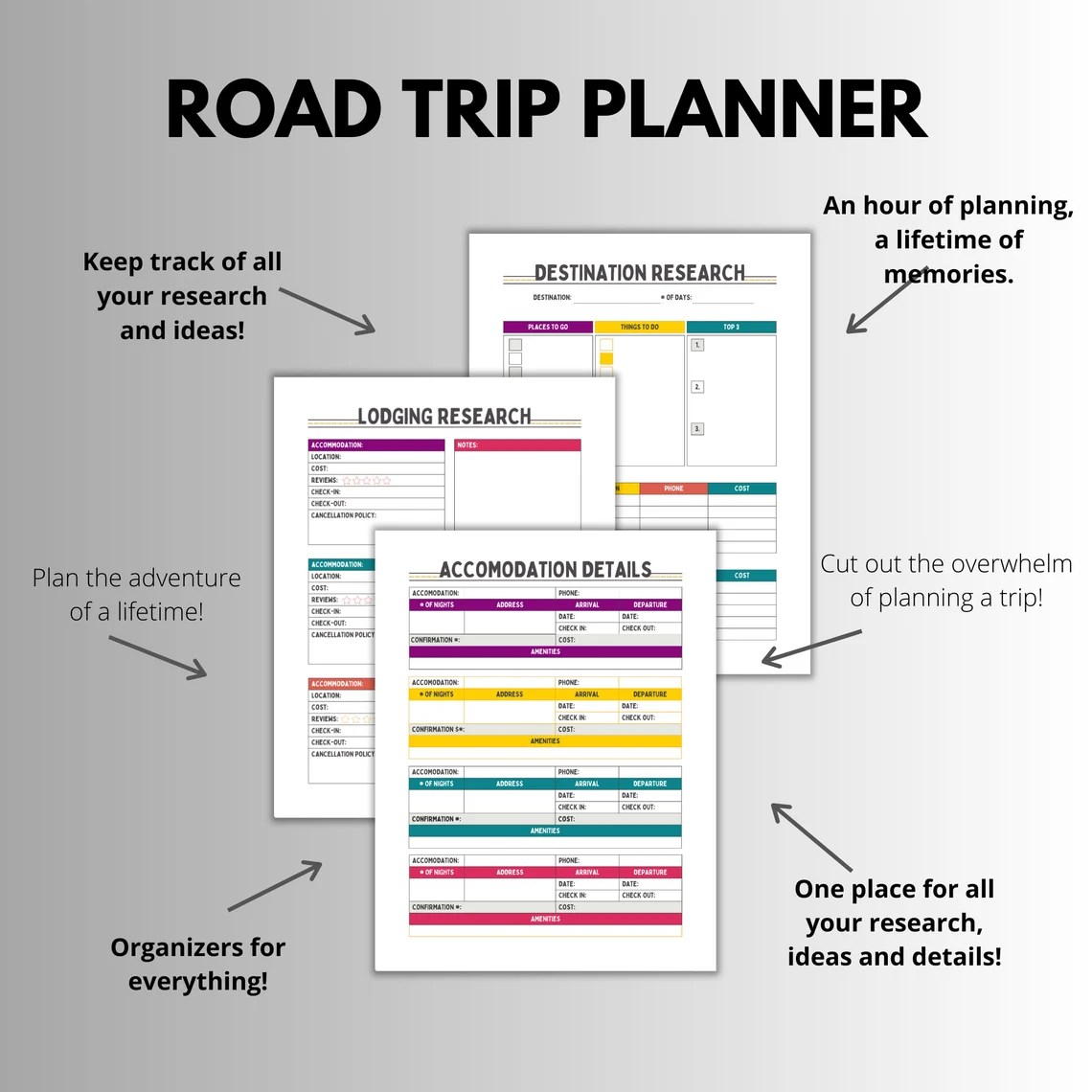

- Advanced Road Trip Tips For Beginners: From Zero To Pro On The Open Road

- Advanced International Travel Download: A Comprehensive Guide To Seamless Global Exploration

- Advanced Trip Organizer Mistakes To Avoid: Level Up Your Travel Planning

- Affordable Currency Exchange Essentials: Your Guide To Saving Money When Traveling Abroad

- The Rise Of Advanced International Travel Apps: Your Pocket-Sized Global Companion

Introduction

With great enthusiasm, we dive into an engaging topic: Affordable Currency Exchange: Navigating the World of Global Finance Without Breaking the Bank. Let’s embark on this journey insights that inform, inspire, and open new perspectives for our readers.

Table of Content

Affordable Currency Exchange: Navigating the World of Global Finance Without Breaking the Bank

In an increasingly interconnected world, the need for currency exchange has become ubiquitous. Whether you’re a seasoned globetrotter, a budding entrepreneur expanding your business internationally, or simply sending money to loved ones abroad, understanding the intricacies of currency exchange is crucial for managing your finances effectively. However, the world of currency exchange can often seem like a labyrinth of fees, rates, and hidden costs, leaving many feeling overwhelmed and unsure of how to secure the most affordable options.

This comprehensive guide aims to demystify the world of affordable currency exchange, providing you with the knowledge and tools necessary to navigate the complexities of global finance without breaking the bank. We’ll delve into the various methods of currency exchange, explore the factors that influence exchange rates, and offer practical tips for minimizing costs and maximizing your returns.

Understanding the Basics of Currency Exchange

At its core, currency exchange involves converting one currency into another. This process is governed by exchange rates, which represent the value of one currency in relation to another. Exchange rates fluctuate constantly due to a myriad of factors, including economic indicators, political events, and market sentiment.

There are two primary types of exchange rates:

- Spot Rate: The spot rate is the current exchange rate for immediate transactions. It reflects the real-time value of a currency pair and is constantly updated based on market conditions.

- Forward Rate: The forward rate is an exchange rate agreed upon today for a transaction that will take place at a specified future date. Forward rates are often used by businesses to hedge against currency risk and lock in a specific exchange rate for future transactions.

Methods of Currency Exchange: Weighing Your Options

When it comes to exchanging currency, you have several options to choose from, each with its own set of advantages and disadvantages. Let’s explore some of the most common methods:

- Banks: Traditional banks are a common choice for currency exchange, offering convenience and familiarity. However, banks often charge higher fees and offer less competitive exchange rates compared to other options.

- Currency Exchange Bureaus: Currency exchange bureaus, such as those found in airports and tourist areas, specialize in currency exchange. While they may offer convenient locations, they typically have higher fees and less favorable exchange rates than other options.

- Online Currency Exchange Platforms: Online currency exchange platforms have gained immense popularity in recent years, offering competitive exchange rates and lower fees than traditional banks and exchange bureaus. These platforms often provide a user-friendly interface and allow you to exchange currency from the comfort of your own home.

- Credit and Debit Cards: Using your credit or debit card for international transactions can be convenient, but it’s essential to be aware of the associated fees. Many credit card companies charge foreign transaction fees, which can add a significant cost to your purchases.

- Peer-to-Peer (P2P) Platforms: P2P platforms connect individuals who want to exchange currency directly with each other, cutting out the middleman and potentially offering better exchange rates. However, P2P platforms may have lower liquidity and require more time to find a suitable match.

Factors Influencing Exchange Rates: A Complex Web of Economics

Exchange rates are influenced by a complex interplay of economic factors, including:

- Inflation Rates: Countries with higher inflation rates tend to see their currencies depreciate in value compared to countries with lower inflation rates.

- Interest Rates: Higher interest rates can attract foreign investment, leading to increased demand for a country’s currency and potentially causing it to appreciate in value.

- Economic Growth: Strong economic growth can boost investor confidence and lead to increased demand for a country’s currency.

- Political Stability: Political stability is crucial for maintaining investor confidence and attracting foreign investment. Political instability can lead to currency depreciation.

- Government Debt: High levels of government debt can raise concerns about a country’s ability to repay its obligations, potentially leading to currency depreciation.

- Trade Balance: A country with a trade surplus (exporting more than it imports) tends to see its currency appreciate in value, while a country with a trade deficit may see its currency depreciate.

- Market Sentiment: Market sentiment, or the overall mood of investors, can also play a significant role in exchange rate movements.

Tips for Affordable Currency Exchange: Maximizing Your Returns

Now that we’ve explored the basics of currency exchange and the factors that influence exchange rates, let’s delve into some practical tips for securing the most affordable options:

- Shop Around and Compare Rates: Don’t settle for the first exchange rate you see. Take the time to shop around and compare rates from different providers, including banks, exchange bureaus, and online platforms.

- Avoid Airport Exchange Bureaus: Airport exchange bureaus are notorious for offering unfavorable exchange rates and charging high fees. Avoid them whenever possible.

- Consider Online Currency Exchange Platforms: Online currency exchange platforms often offer the most competitive exchange rates and lower fees compared to traditional banks and exchange bureaus.

- Be Mindful of Fees: Pay close attention to the fees charged by different providers. Some providers may advertise attractive exchange rates but then tack on hidden fees that can significantly increase the overall cost.

- Use a Credit Card with No Foreign Transaction Fees: If you’re using a credit card for international transactions, choose a card that doesn’t charge foreign transaction fees.

- Withdraw Cash from ATMs Strategically: Withdrawing cash from ATMs in your destination country can be a convenient option, but be mindful of the fees charged by your bank and the ATM operator. Opt for ATMs that are part of a global network to minimize fees.

- Negotiate Exchange Rates: If you’re exchanging a large sum of money, don’t be afraid to negotiate the exchange rate with the provider.

- Consider Using a Prepaid Travel Card: Prepaid travel cards can be a convenient and secure way to manage your money while traveling abroad. Load the card with the desired currency and use it for purchases and ATM withdrawals.

- Stay Informed About Exchange Rate Trends: Keep an eye on exchange rate trends to identify opportunities to exchange currency when rates are favorable.

- Plan Ahead: Don’t wait until the last minute to exchange currency. Planning ahead allows you to shop around for the best rates and avoid the stress of rushing.

- Use a Currency Converter: Use a currency converter to get an accurate estimate of the amount of currency you’ll receive after the exchange.

- Read Reviews: Before using an online currency exchange platform, read reviews from other users to get an idea of their experiences.

- Be Aware of Scams: Be wary of scams that promise unrealistic exchange rates or require you to pay upfront fees.

- Consider the Timing of Your Exchange: Exchange rates fluctuate constantly, so the timing of your exchange can impact the overall cost. Try to exchange currency when rates are favorable.

- Hedge Against Currency Risk: If you’re a business that regularly engages in international transactions, consider hedging against currency risk by using forward contracts or other financial instruments.

Conclusion: Empowering Your Financial Decisions in a Globalized World

In conclusion, affordable currency exchange is within reach if you take the time to understand the intricacies of the market and explore the various options available to you. By shopping around, comparing rates, being mindful of fees, and staying informed about exchange rate trends, you can minimize costs and maximize your returns. Whether you’re a frequent traveler, a business owner, or simply sending money to loved ones abroad, mastering the art of affordable currency exchange will empower you to make informed financial decisions in an increasingly globalized world.

Remember, knowledge is power. By equipping yourself with the information and tools necessary to navigate the world of currency exchange, you can unlock significant savings and ensure that your money goes further, no matter where your travels or business ventures take you.