“Comprehensive Currency Exchange 2025: A Deep Dive into the Future of Global Finance

Related Articles Comprehensive Currency Exchange 2025: A Deep Dive into the Future of Global Finance

- The Ultimate Packing List: Your Stress-Free Guide To Organized Travel

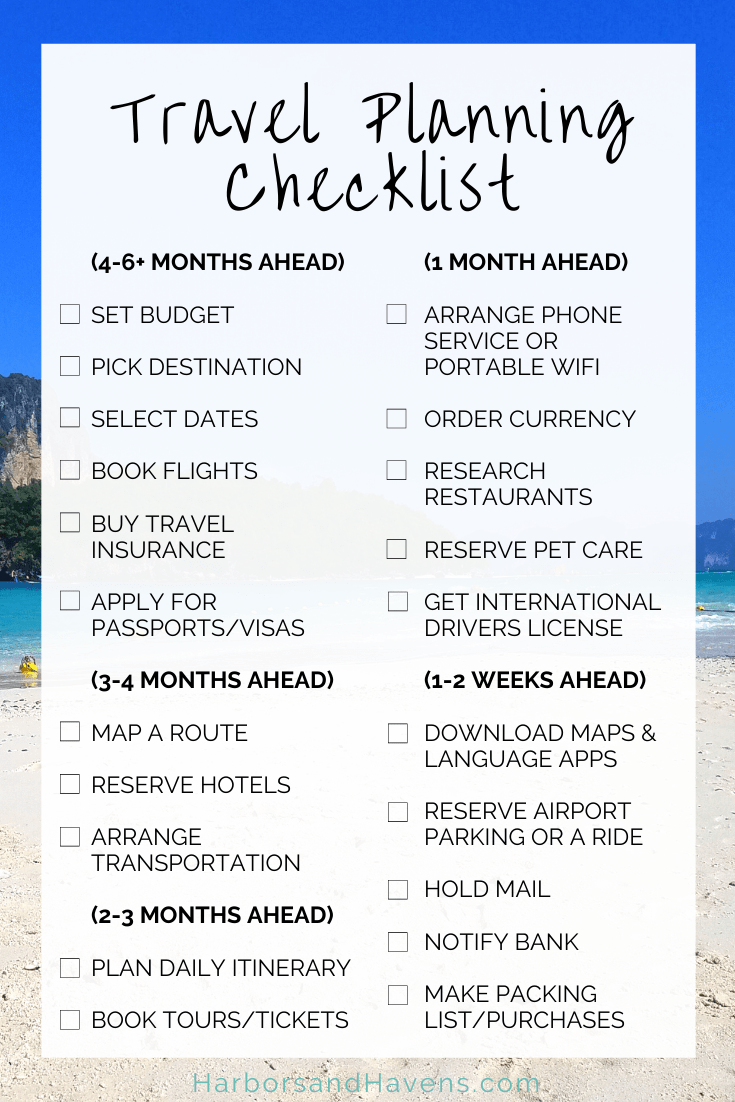

- The Ultimate Guide To Trip Planning: Transforming Dreams Into Unforgettable Journeys

- Beginner’s Guide To Budget Travel: An Affordable Adventure

- Level Up Your Journey: Advanced Travel Tips And Mistakes To Avoid

- The Ultimate Guide To Solo Travel Resources: Planning, Safety, And Inspiration

Introduction

On this special occasion, we’re delighted to explore an engaging topic: Comprehensive Currency Exchange 2025: A Deep Dive into the Future of Global Finance. Join us as we navigate insights that inform, inspire, and open new perspectives for our readers.

Table of Content

Comprehensive Currency Exchange 2025: A Deep Dive into the Future of Global Finance

The global financial landscape is in a constant state of flux, driven by technological advancements, geopolitical shifts, and evolving economic paradigms. As we approach 2025, the realm of currency exchange is poised for a dramatic transformation, marked by increased efficiency, transparency, and accessibility. This article delves into the key trends and developments shaping the future of comprehensive currency exchange, exploring the potential impact on businesses, consumers, and the global economy.

I. The Rise of Digital Currencies and Blockchain Technology

One of the most significant disruptors in the currency exchange landscape is the emergence of digital currencies and blockchain technology. Cryptocurrencies like Bitcoin and Ethereum have gained traction as alternative forms of payment and investment, challenging the dominance of traditional fiat currencies.

- Decentralization and Transparency: Blockchain technology, the foundation of most cryptocurrencies, offers a decentralized and transparent ledger system. This eliminates the need for intermediaries like banks and clearinghouses, reducing transaction costs and processing times.

- Cross-Border Payments: Cryptocurrencies facilitate seamless and cost-effective cross-border payments. Traditional currency exchange often involves hefty fees and lengthy processing times, making it less efficient for international transactions. Digital currencies can bypass these hurdles, enabling faster and cheaper global payments.

- Central Bank Digital Currencies (CBDCs): Recognizing the potential of digital currencies, many central banks are exploring the development of their own digital currencies (CBDCs). These digital versions of fiat currencies could revolutionize the way money is exchanged and managed within a country.

- Challenges and Regulations: Despite their potential, digital currencies face challenges such as price volatility, regulatory uncertainty, and security concerns. Governments and regulatory bodies are working to establish frameworks for regulating digital currencies and ensuring consumer protection.

II. The Impact of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) are transforming various aspects of the financial industry, and currency exchange is no exception. These technologies are being used to enhance efficiency, accuracy, and risk management in currency trading and exchange processes.

- Algorithmic Trading: AI-powered algorithms can analyze vast amounts of data to identify patterns and trends in currency markets. This enables traders to make informed decisions and execute trades automatically, optimizing profitability and reducing risk.

- Fraud Detection: AI and ML algorithms can detect fraudulent activities in currency exchange transactions. By analyzing transaction patterns and identifying anomalies, these technologies can help prevent money laundering and other illicit activities.

- Personalized Currency Exchange Services: AI can be used to personalize currency exchange services based on individual customer needs and preferences. For example, AI-powered platforms can offer customized exchange rates, transaction recommendations, and risk management strategies.

- Improved Customer Service: AI-powered chatbots and virtual assistants can provide instant customer support and answer queries related to currency exchange. This improves customer satisfaction and reduces the burden on human customer service agents.

III. The Growing Importance of Mobile and Online Platforms

Mobile and online platforms have become increasingly popular channels for currency exchange. These platforms offer convenience, accessibility, and competitive exchange rates, attracting a growing number of users.

- Convenience and Accessibility: Mobile and online platforms allow users to exchange currencies from anywhere with an internet connection. This eliminates the need to visit physical currency exchange locations, saving time and effort.

- Competitive Exchange Rates: Online currency exchange platforms often offer more competitive exchange rates compared to traditional banks and currency exchange bureaus. This is due to lower overhead costs and increased competition.

- Transparency and Comparison: Mobile and online platforms provide transparency in currency exchange rates and fees. Users can easily compare rates from different providers and choose the best option for their needs.

- Integration with Other Financial Services: Many mobile and online platforms integrate currency exchange with other financial services, such as international money transfers, investment accounts, and travel booking. This provides a seamless and integrated financial experience for users.

IV. The Role of Regulatory Technology (RegTech)

Regulatory technology (RegTech) is playing an increasingly important role in ensuring compliance and mitigating risks in the currency exchange industry. RegTech solutions automate regulatory processes, enhance transparency, and improve risk management.

- Anti-Money Laundering (AML) Compliance: RegTech solutions help currency exchange providers comply with anti-money laundering (AML) regulations. These solutions automate customer due diligence (CDD), transaction monitoring, and suspicious activity reporting (SAR).

- Know Your Customer (KYC) Compliance: RegTech solutions streamline the know your customer (KYC) process, making it easier for currency exchange providers to verify the identity of their customers. This helps prevent fraud and money laundering.

- Regulatory Reporting: RegTech solutions automate the process of regulatory reporting, ensuring that currency exchange providers comply with reporting requirements. This reduces the risk of penalties and fines.

- Risk Management: RegTech solutions help currency exchange providers identify and mitigate risks related to currency fluctuations, fraud, and compliance. This improves the overall stability and resilience of the industry.

V. The Impact of Geopolitical Factors

Geopolitical events and economic policies can have a significant impact on currency exchange rates. Factors such as political instability, trade wars, and interest rate changes can influence the value of currencies and create volatility in the market.

- Political Instability: Political instability in a country can lead to uncertainty and risk aversion, causing the value of its currency to decline.

- Trade Wars: Trade wars between countries can disrupt global trade flows and impact currency exchange rates. For example, tariffs and trade restrictions can lead to currency depreciation in affected countries.

- Interest Rate Changes: Central banks often adjust interest rates to influence inflation and economic growth. Changes in interest rates can affect currency exchange rates, as higher interest rates tend to attract foreign investment and increase the value of a currency.

- Economic Policies: Government policies such as fiscal stimulus and tax reforms can also impact currency exchange rates. These policies can affect economic growth, inflation, and investor sentiment, which in turn can influence the value of currencies.

VI. The Future of Currency Exchange 2025: Key Trends and Predictions

As we look ahead to 2025, several key trends and predictions emerge for the future of comprehensive currency exchange:

- Increased Adoption of Digital Currencies: Digital currencies are expected to gain wider acceptance and adoption, both by consumers and businesses. This will lead to increased demand for currency exchange services that support digital currencies.

- Greater Integration of AI and ML: AI and ML will become more deeply integrated into currency exchange processes, enhancing efficiency, accuracy, and risk management.

- Expansion of Mobile and Online Platforms: Mobile and online platforms will continue to grow in popularity, offering convenience, accessibility, and competitive exchange rates.

- Enhanced Regulatory Oversight: Regulatory oversight of the currency exchange industry will increase, with a focus on AML compliance, consumer protection, and data security.

- Greater Transparency and Standardization: Efforts will be made to increase transparency and standardization in currency exchange rates and fees, making it easier for consumers to compare and choose the best options.

- Personalized and Customized Services: Currency exchange providers will offer more personalized and customized services, tailored to individual customer needs and preferences.

- Focus on Sustainability: The currency exchange industry will increasingly focus on sustainability, with efforts to reduce its environmental impact and promote ethical practices.

VII. Conclusion

The world of currency exchange is undergoing a profound transformation, driven by technological innovation, evolving regulatory landscapes, and shifting geopolitical dynamics. As we approach 2025, comprehensive currency exchange will be characterized by increased efficiency, transparency, and accessibility. Digital currencies, AI, mobile platforms, and RegTech will play pivotal roles in shaping the future of the industry, empowering businesses and consumers with more convenient, cost-effective, and secure currency exchange solutions. By embracing these advancements and adapting to the evolving landscape, stakeholders can unlock new opportunities and navigate the complexities of the global financial system with confidence. The future of currency exchange is not just about exchanging money; it’s about connecting people and economies in a more seamless and efficient manner.